Industry

Client

Baleen

Year

2022

Baleen Solutions set out to streamline one of the most tedious and error-prone parts of the lending process: income analysis. For decades, loan officers and processors have had to manually review and calculate income from a borrower’s tax documents. The work is time-consuming, complex, and often inconsistent, especially when handling self-employed borrowers or small businesses. Mistakes can delay approvals or trigger compliance issues.

Baleen, founded by a seasoned loan officer with over 30 years of experience, aimed to apply AI and Optical Character Recognition (OCR) to automate income analysis. The potential was clear—but the initial product had critical issues. The OCR engine frequently broke, document tracking was unreliable, and core workflows introduced more confusion than clarity.

We were brought in for a focused four-week sprint to redesign the platform from the ground up, with the goal of creating a system that was fast, flexible, and trustworthy for real-world underwriting teams.

Each scenario involved juggling documents, making judgment calls, and working with teammates like underwriters or processors. Our goal was to build a tool that would support this complexity—without getting in the way.

Design Definition

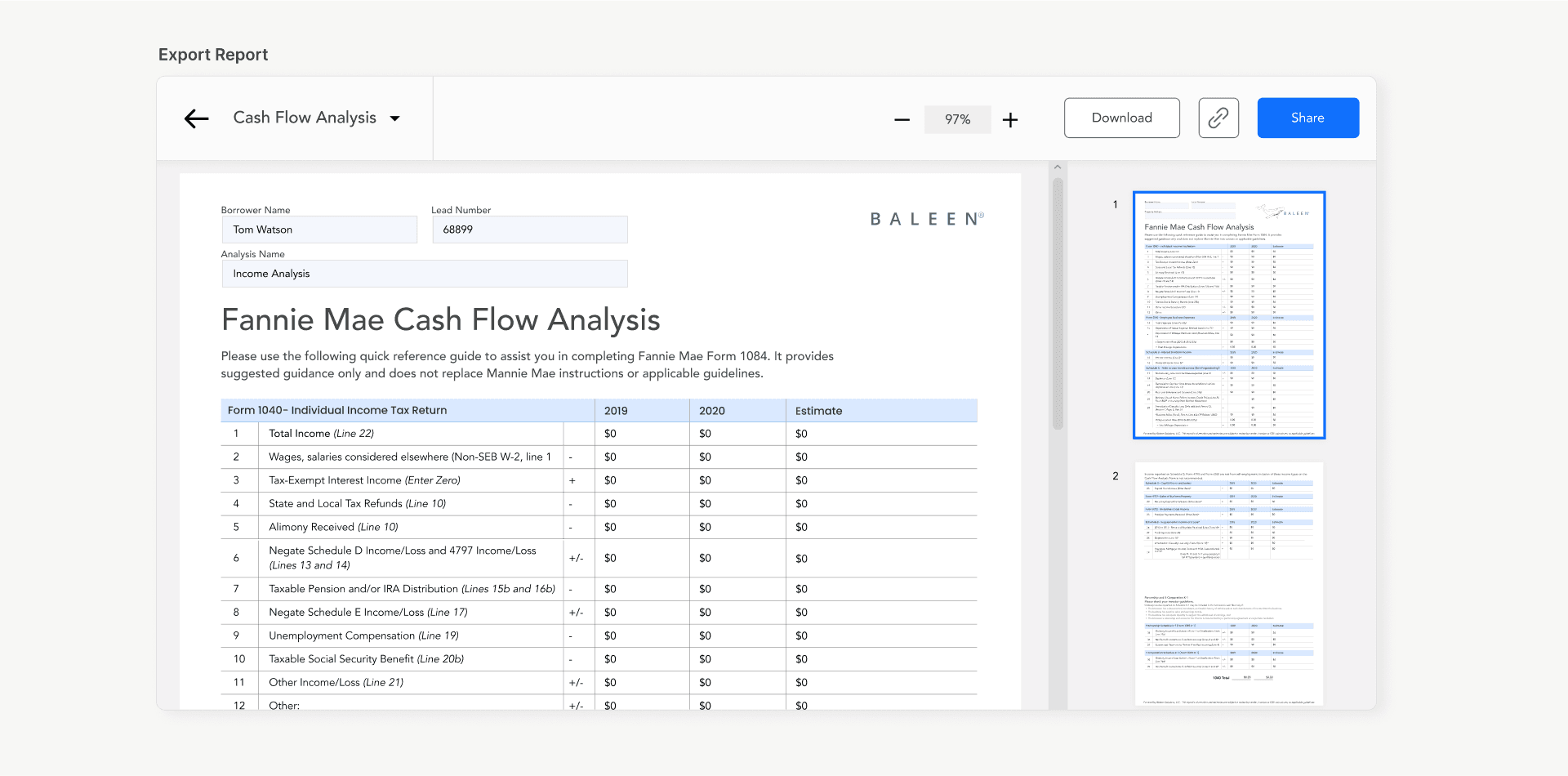

The centerpiece of the product became a spreadsheet-style table. Loan officers are deeply familiar with spreadsheets and needed a single view to analyze, edit, and summarize income data by individual and by category—like W-2, self-employment, or corporate income. The table would allow inline editing, structured nesting, and dynamic linking to document fields.

To support AI integration, we designed a system of flags and confirmations. If OCR detected low-confidence data or missing information, the platform would alert the user and guide them to confirm or adjust values. These AI suggestions were placed contextually in the UI, helping the processor maintain control without feeling overwhelmed.

To move quickly, we adapted an off-the-shelf Bootstrap component library and extended it with custom styles and behaviors. This allowed us to build accessible, lightweight UIs with standard inputs, tables, alerts, and modals—while focusing design attention on the interactions that mattered most.

Outcome

The result was a secure, cloud-based platform that automated over 70% of the manual work involved in income analysis. Loan officers no longer needed to rely on external spreadsheets. Instead, they could upload documents, see real-time OCR results, make corrections, and export underwriter-ready reports—all in one place.

The table-driven interface offered clarity and familiarity. OCR results appeared directly in editable fields, with AI-generated flags and side-panel guidance helping users spot inconsistencies. Officers could manage and confirm assumptions, track documents, and leave notes for teammates—all within the workflow.

Most importantly, the product gave teams control without requiring them to micromanage the automation. By making the AI assistive instead of intrusive, we restored trust and created a smoother path from application to approval.

Prototype Recording: https://youtu.be/aPMBEH_cUoU